The US’ gold holdings, allegedly the largest on the planet, have not been subjected to a comprehensive audit since the 1950s.

To begin with, a couple of important caveats. First, Naked Capitalism is not a platform for gold bugs. As Yves noted in the preamble to an April 2022 cross-posted article by The Saker, The Importance of Custody, Or NATO’s Internal Gold War, “even mentioning gold on this site makes [her] nervous, since it brings forth all the gold bugs and other super-hard currency fans”:

Repeat after me: Japan created money supply like a drunken sailor for the better part of two decades and still barely prevented deflation. William Jennings Bryan’s “Cross of gold” speech came about because the gold standard in the latter 1800s produced the so-called “Long Depression” that hit farmers hard.

Even though this post is about not taking proper care of one’s gold, as in poor custody practices, we suspect some readers will use it as an excuse to talk up a gold standard. Please don’t. Read this instead:

Why a gold standard is a very bad idea

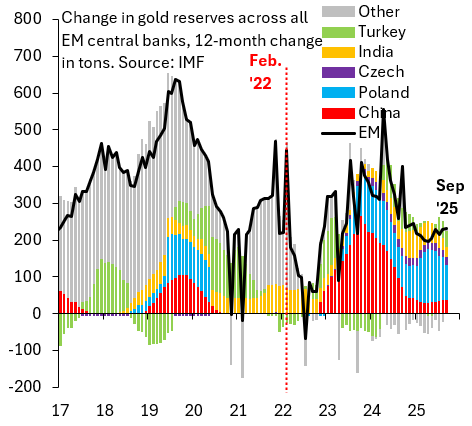

Second, there is a huge amount of chatter, in both social and financial media, that the recent price surges are being driven by central bank buying. We’re not convinced. While central banks are certainly buying more of the yellow metal, it is retail, and to a lesser extent, institutional buying, that are the main catalysts here, as Robin J Brooks lays out in his latest substack:

The chart below shows IMF data on gold buying for all emerging markets. Four points are worth noting. First, there is no acceleration of gold buying after Feb. ‘22, which is when Russia invaded Ukraine and the sanctions onslaught began. Second, central banks are certainly buying gold, but they’re doing so at a slow and steady pace. They’re not in a buying frenzy that explains the massive rise in gold prices underway. Third, it’s possible that countries are hiding their gold purchases. China is almost surely doing that. After all, it conceals its intervention in foreign exchange markets via state banks, so what’s to prevent it from hiding gold purchases? But – again – this is unlikely to be happening with the kind of frenzy that can explain the current run-up. Fourth, even if foreign central banks are buying gold, they’re not also buying silver, platinum or palladium.

[NC: It would be nice to know what central bank buying was like before 2017, given that was the year that gold was reclassified from a Tier 3 to a Tier 1 asset under the Basel III banking reforms, turning gold into a more effective backstop for debt, currencies and bank capital.]

At the root of the surging retail and institutional demand for gold is a generalised fear about unsustainable fiscal policy and dollar debasement, says Brooks:

The Dollar was stable in the second half of 2025, even as gold prices and the debasement trade got going. That is changing. As the chart below shows, the Dollar had a very bad start to 2026, in line with my call that Dollar weakness will resume after the hiatus of H2 2025. A falling Dollar will super-charge the rise in gold prices and the debasement trade because it boosts the purchasing power of non-Dollar buyers. The trajectory is thus for the debasement trade to accelerate as Dollar weakness resumes.

Goldman Sachs has already revamped its 2026 price target for gold, arguing that investors are treating gold as an insurance against long-term risks, including soaring debt levels, rising risks in the bond markets, and growing uncertainty over central bank independence. That’s not to mention the growing fears of a collapse in the AI bubble.

The Role of Price Manipulation

What rarely gets mentioned in mainstream media coverage is the historic role played by price manipulation, not just in the gold market but also in the silver, platinum and palladium markets. One of the most notorious cases involved JPMorgan Chase, which in 2020 was found guilty of spoofing silver and gold prices through illegal trading practices. The Wall Street lender ended up paying a $920 million fine.

In total, eight banks paid fines of $1.3 billion for decades of manipulation — just a minor cost of doing business. Since then the manipulation has tailed off, as JP Morgan has shifted from a massive net short position in silver to massive net long, allowing true price discovery (or at least something resembling it) to take place. As Michael Hudson explained in an interview on CTGN Europe’s The Agenda, the Fed is also similarly restrained in its ability to keep down gold prices:

So for the last few decades, the Federal Reserve and the U.S. Treasury have been trying to hold down the price of gold to make sure that it wouldn’t appear as an alternative investment. And it’s been selling gold forward or it’s been leasing its gold, not only from Fort Knox, but apparently from the Federal Reserve, to gold dealers, and selling gold short on the Comex Exchange. And by selling gold short, that prevents any opportunity for the price of gold really going up.

Well, finally, as you pointed out, in the last few years, it’s leased so much gold that it’s reached the end of its ability to hold it down. And now, for the first time, we’re having a real market developing in gold. And all that’s gone hand in hand with the desire of a number of governments to say they want to de-dollarize. And from the idea of people that, well, maybe we need to diversify out of the dollar, now that the political and military situation[s] are changing. So all of that has led to increased speculation of gold.

China’s opening of its own precious metal exchanges in recent years has also played a key part in muting the ability of US and UK authorities and Western bullion banks to engage in price manipulation of the metals markets.

According to global markets expert Kathleen Turner, China, unlike the US and the UK, is banning High Frequency Execution server co-location at exchanges in order to prevent banks from “spoofing” markets.

Now, to the main story: the growing jitters in Germany about having so much of its gold reserves stored at the US Federal Reserve, especially given the Trump administration’s near-total disregard for a) international law; b) central bank independence, and c) the property rights of other nation states (c.f. Venezuelan oil and gold, Russian assets held in the West, Greenland).

German economists and politicians are once again calling for the full repatriation of Germany’s gold — understandable given the yellow metal just crossed the $5,000 per ounce threshold for the first time ever while concerns about sovereign bond markets continue to grow. According to official records, Germany has the second largest gold reserves in the world, totalling around 3,550 tons, of which roughly half are stored abroad.

The lion’s share (1,236 tons) are held at the Federal Reserve Bank in New York while another 405 tons are held at the Bank of England. This was a holdover from the Cold War, when Western Europe’s gold bullion was moved for “safe keeping” to London and New York, far away from the former Soviet Union and Josef Stalin.

German economists are now beginning to express concerns about how just safe that gold is, reports Tagesschau (machine translated):

Gold [held in the US] was considered safe for years. This is because central banks are usually independent and have a great deal of trust in each other. But US President Donald Trump is trying to change that. In recent months, he has increasingly launched attacks with the aim of undermining the Fed’s independence. Most recently, he threatened Federal Reserve Chairman Jerome Powell with charges in connection with the renovation of Fed buildings. Powell himself sees this as just a pretext to exert pressure.

Previously, Trump had already tried to fire Fed Governor Lisa Cook. The case is currently before the Supreme Court. For months, Trump has been urging Fed Chairman Powell to cut interest rates faster and more extensively, often with insulting posts on his Truth Social platform.

“Of course, the more central banks come under political pressure — and we are currently experiencing this in the USA — the more difficult it will be to maintain this basis of trust,” said gold expert Wolfgang Wrzesniok-Roßbach of Fragold in Frankfurt. One must closely observe how Trump continues to deal with the Fed and how independent it will be in the future.”

This account leaves out two key points: first, as Satyajit Das argued in a post last week for Naked Capitalism, central bank independence is a relatively recent phenomenon, dating back to the 1990s, and is not all it’s cracked up to be; and second, Germany has been seeking to repatriate its gold held overseas for over a decade, and has so far only managed to claw back 300 of the more than 1,500 tons held overseas.

What’s more, as the aforementioned The Saker article notes, Berlin had to wait five long years to repatriate that small portion of its gold from the BoE. Plus, it never got back any of the gold bars originally deposited, which clearly explains the delay. This raises some key questions:

(a) does the BoE still have all of the EU´s gold bullion… or has it been sold off or loaned out as many experts insist ?

(b) is the BoE willing and able to immediately return the EU gold it may still have left to legitimate owners, if any ?

(c) who are the legitimate owners of BoE-vaulted gold after decades of European reshuffling of political borders ?

(d) would the ECJ decide gold ownership… or the British Judiciary… or the BoE ? On what basis, exactly ?

(e) has the BoE lent, swapped, re-hypothecated, leased, leveraged or encumbered such bullion now lien with other many alleged legitimate claimees also standing in line with ´fractional un-allocated synthetic´ bullion custodies unfit-for-purpose per “Digital Derivative Pricing Schemes“ thru which no one can know who owns what where (if anything) ?

Audit the Fed?

All of these questions could just as easily be asked about the gold held at the Federal Reserve. After all, the US’ gold holdings, allegedly the largest on the planet, which include the gold holdings of dozens of other countries held in custody by the US Federal Reserve, have not been subjected to a comprehensive audit since the 1950s.

Last year, four members of Congress, led by Thomas Massie, introduced a bill to initiate the first full assay, inventory, and audit of all United States gold holdings in decades. Now, the whipsaw whims of Trump 2.0 pose an additional risk factor, notes the Tagesschau piece:

“The gold reserves are currently safe in the USA. But tomorrow it could be the case that suddenly the American government says: ‘We are now keeping the gold reserves as a bargaining chip’,” says [gold expert Wolfgang] Wrzesniok-Roßbach. The Donald Trump risk factor is great. “At the moment, the US is not a reliable partner of the EU,” the president of the Centre for European Economic Research (ZEW), Achim Wambach, told Reuters news agency.

Emanuel Mönch, a former head of research at the Bundesbank, called for the gold to be brought home, saying it was too “risky” for it to be kept in the US under the current administration.

“Given the current geopolitical situation, it seems risky to store so much gold in the US,” Mönch told Handelsblatt. “In the interest of greater strategic independence from the US, the Bundesbank would therefore be well advised to consider repatriating the gold.”

For the moment, Berlin is not looking to go there, says Stefan Kornelius, the spokesperson for Friedrich Merz’s coalition government. But calls are rising for the government to take action, including among some politicians. Meanwhile, nearly three-quarters of the German public now see the US as an unreliable partner, according to the most recent ARD-Deutschland trend poll.

Michael Jäger, the head of the Association of German Taxpayers, warns that the US’s stated ambition to seize Greenland should concentrate minds:

Trump is unpredictable and he does everything to generate revenue. That’s why our gold is no longer safe in the Fed’s vaults. What happens if the Greenland provocation continues? … The risk is increasing that the German Bundesbank will no longer be able to access its gold. Therefore, it should repatriate its reserves.

A Colossal Loss of Trust

Western central bankers are also up in arms about Trump’s recent moves against the Federal Reserve. It’s no coincidence that it was Mark Carney who called time on the rules based order from Davos last week. Carney may currently be prime minister of Canada but he is first and foremost a central banker.

Indeed, Carney is the only person ever to have run two different central banks: the Bank of Canada (2008-2013) and the Bank of England (2013-2020). As such, his speech was primarily on behalf of his constituents in Wall Street and the City of London.

The money quote: “compliance will not buy safety”…