The world’s largest bilateral trade relationship continues to grow, but it’s a trend that is unlikely to last.

Donald Trump’s tariffs have not slowed down Mexican exports to the United States, as many predicted. On the contrary, in the first quarter of 2025, Mexico sold goods worth $131 billion, an unprecedented figure since records began, according to information from the US Department of Commerce’s Census Bureau. It represents a whopping 9.6% increase on the $119.8 billion reported in the same period of 2024.

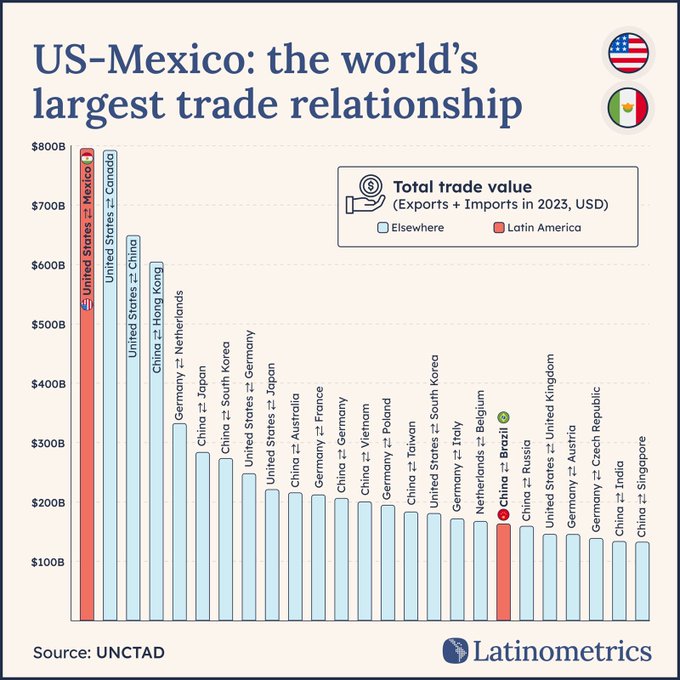

It was a similar story for Mexico’s imports from the US, which surged by 4.8% year on year to $84 billion. The result is that total trade between the two countries reached $215 billion in the first quarter, another historic record. After notching up a total value of $840 billion last year, the world’s largest bilateral trade relationship seems, at first blush, to be going from strength to strength.

Mexico’s exports to the US surged in the first three months of this year despite the fact that since February 4 the Trump administration has imposed a 25% tariff on all Mexican export goods that are not covered by the USMCA trade deal, which is just over half of the total. Also, since March 12 the Trump administration has imposed a 25% tariff on Mexican exports of steel, aluminium and some derivatives of both metals, including canned beer.

Yet despite Trump’s tariffs, Mexico, like Canada and China, the US’ second and third largest trade partners, increased its earnings from exports sent to the US in the first quarter of 2025. But this is a trend that is unlikely to last, especially if the US enters recession.

In fact, trade between the US and fellow USMCA member Canada already fell sharply in March after the outgoing Trudeau government imposed retaliatory tariffs on the US — something Mexico’s Sheinbaum government has so far ruled out doing — which prompted further retaliatory tariffs from Trump. While Canada’s trade with the US slumped in March, its trade with other countries surged, reports Bloomberg:

The Trump administration’s duties on Canadian steel, aluminum, autos and other products, as well as Canada’s retaliatory levies on a range of American goods, led to a large pullback in activity between Canada and its largest trading partner in March. Exports to the US plunged 6.6%, the biggest drop in nearly five years, while imports fell 2.9%, Statistics Canada data showed Tuesday.

Exports to other countries jumped 24.8%, however, almost entirely offsetting the decline in outbound shipments to the US. Imports from other countries were also up 1%. As a result, Canada’s merchandise trade deficit with the world narrowed to C$506 million, down from C$1.4 billion in February and beating the C$1.6 billion shortfall expected in a Bloomberg survey of economists.

The country’s trade surplus with the US narrowed to C$8.4 billion, from C$10.8 billion in February.

While Canadian companies are looking to expand their domestic market and overseas markets beyond the US, the reality is that Canadian companies that are heavily dependent on the US market will struggle to make up for trade lost with the US elsewhere if Trump continues to hike tariffs on Canadian goods. This is particularly true if the global economy enters a downturn, as is looking increasingly likely. From Reuters:

While some Canadian companies have lost trust, those reliant on the U.S. market cannot entirely replace it, especially smaller firms, companies and industry associations have said.

Canada’s economy is less than a tenth the size of its neighbor and shipping overseas is costly.

Meanwhile, the US’ trade deficit with Mexico continues to grow, reaching $140.5 billion in the first quarter of 2025, according to the Census Bureau. This is all happening not just despite but in large part because of Trump’s tariffs.

Since Trump began tariffing the world, both consumers and businesses have been front-loading imports from countries subject to relatively lower tariffs, including Mexico, out of fear that the tariffs will spike again once Trump’s 90-day pause ends on July 9. Though Trump has implemented various tariffs targeting Mexico as part of his broader trade policy, he excluded the country from his list of nations facing steep “reciprocal tariffs.”

Amid the recent panic buying, US imports jumped 41.3% for the quarter — the largest rise since the third quarter of 2020, when many global economies, including the US, began to emerge from the first lockdowns. This explosion in pre-tariff imports has been identified as one of the main factors behind the US economy’s sharp slowdown in the first quarter.

Unfortunately for Mexico, the relief is likely to be short lived. As US businesses and consumers grapple with rising prices and supply shortages, consumption will inevitably fall.

It has also taken time for Trump’s tariffs to feed through to customers, but that is now beginning to happen. Just this week, Ford announced price rises of up to $2,000 on three models produced in Mexico, the Maverick, Bronco Sport and Mach-E, citing higher US tariffs on imported vehicles as one reason for the adjustment. US retailers expect a drop of 20-30% in imports in the coming months, according to Goldman Sachs analysts.

As Yves warns in her post Complacency, Denialism and the Risk of an Economic Trumpocalypse, given the scale of disruption and dislocations caused thus far, not just by Trump’s tariffs but also DOGE and the immigration crackdown, “it’s hard to have a good picture of where things stand in in the US and where the bottom might be”:

That is not merely the result of information being retrospective in what looks to be a rapidly accelerating downswing, but also small businesses and/or intermediate goods producers taking the biggest hits, and they are generally not well studied.

But based on the tone of the press, discussions with people in the US, and a very recent and short trip to New York City,1 much, and arguably too much, of the US seems to be in summer of 1914 mode: cheerfully living in a sense of normalcy that is about to vanish permanently. To put it another way, if there was a sufficiently widespread appreciation of what was looming over the horizon, May 1 would have seen the launch of open-ended general strikes.

Trump really is well on his way to implementing a reactionary restructuring of the US and international economy. “The end of globalization” is too bloodless a formula to convey the severity of the dislocations that have only started to arrive.

Even in the vanishingly unlikely scenario that Trump were to abandon his tariff policies in the next week, the confusion and interruption of supplies will still have done considerable harm. The longer they remain in place, the more that damage, particularly small business closures and downsizings at small and bigger enterprises, will become permanent.

The High Costs of Dependence

And that is bad news for the US’ largest trade partner, Mexico…

Continue reading on Naked Capitalism