“Beijing is now the main trading partner for most nations in the region and has the fastest-growing stock of investments.”

On August 17, 2021, we published an article titled “The US Is Losing Power and Influence Even In Its Own Back Yard.” It was the first in a series of articles that have traced how China has gradually surpassed the US as South America’s main trading partner and has even begun chipping away at US economic dominance over parts of Central America, the Caribbean and, more recently, Mexico. From that initial article:

Unlike the US, China generally does not try to dictate how its trading partners should behave and what sorts of rules, norms, principles and ideology they should adhere to. What China does — or at least has by and large done over the past few decades until now — is to trade with and invest in countries that have goods — particularly commodities — it covets…

In Latin America and the Caribbean it has worked a treat. China’s rise in the region coincided almost perfectly with the Global War on Terror. As Washington shifted its attention and resources away from its immediate neighbourhood to the Middle East, where it frittered away trillions of dollars spreading mayhem and death and breeding new terrorists, China began snapping up Latin American resources. Governments across the region, from Brazil to Venezuela, to Ecuador and Argentina, took a leftward turn and began working together across various fora. The commodity supercycle was born.

China’s trade with the region grew 26-fold between 2000 and 2020, from $12 billion to $315 billion, and is expected to more than double by 2035, to more than $700 billion.

[Recent data suggest it is well on track to achieving that. In 2023, the total trade volume between China and Latin America reached a record $480 billion, according to China’s National Customs Administration]

In the last 20 years China has moved from an almost negligible position as a source of imports and destination of exports within the region to become its second trade partner, at the expense not just of the US but also Europe and certain Latin American countries such as Brazil whose share of inter-regional trade has fallen. According to the World Economic Forum, “China will approach—and could even surpass—the US as LAC’s top trading partner. In 2000, Chinese participation accounted for less than 2% of LAC’s total trade. In 2035, it could reach 25%.”

A Thousand-Word Photo?

The potential ramifications of China’s rise to dominance of South America, a region whose fortunes and resources have been largely controlled by Europeans and their North American descendants for the best part of the past 500 years, appear to be finally dawning on the West. The German broadcaster DW reported last week that “Alarm bells are ringing in the United States,” citing an article by Swiss newspaper Neue Zürcher Zeitung:

“As a supplier of raw materials, South America has great economic importance for China’s development. This is where 45 percent of the agricultural products traded on the world market come from. Meat and soybean exports are particularly important for the nutrition of the Chinese population. South America also supplies two fundamental minerals for the energy transition: lithium and copper. Two-thirds of the known lithium reserves and forty percent of the copper reserves are located in the region. Chile and Peru are the two largest copper producers in the world. (…)

Spain’s El País warned that the Asian giant is expanding its political and economic influence in the region, eroding the role of the West and putting Washington and Brussels on alert. The Financial Times appears to have reached the same conclusion. In a “Global Insight” op-ed on Wednesday, the pink paper’s Latin American editor, Michael Stott, averred that Joe Biden has lost to Xi Jinping in the “battle for Latin-America”:

“Beijing is now the main trading partner for most nations in the region and has the fastest-growing stock of investments.”

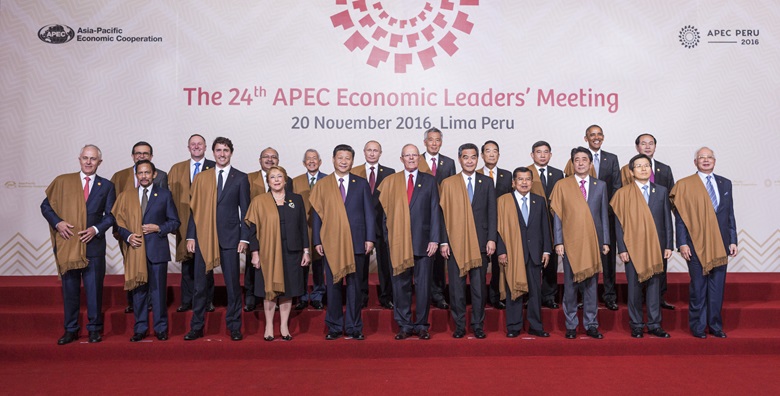

The article notes that Biden’s farewell trip to Brazil and Peru “epitomises Washington’s waning influence” in the region, citing photos from last week’s Apec summit in Peru and this week’s G20 meeting in Brazil as visual proof of that waning influence. In both photos Xi Jinping stands front and centre in the first row while Biden “lingers near the end of the back row in one picture and is absent from the other.” There are, however, official explanations for this that have nothing to do with the US and China’s relative strategic influence:

In the first picture at last week’s Apec summit in Peru, leaders stood in alphabetical order, which favoured China over a rival superpower starting with U. In the second, shot at this week’s G20 meeting in Rio de Janeiro, US diplomats said the group photo was taken early, before Biden had arrived.

As we can see in this photo of the 2016 Apec summit, also in Peru, Obama was also close to the end of the back row.

Nonetheless, as the op-ed notes, “the summit photographs serve as metaphors for the eclipse of the US by China in Latin America, a region that Washington used to call its backyard,” and which Biden has called its “front yard”, as if that were somehow better.

China Making Moves

A better illustration of the two rival superpowers’ sharply contrasting approaches in Latin America was on display last week at the opening of Peru’s Chancay megaport, at which Xi Jinping made a guest appearance. What was China’s paramount leader doing attending the inauguration of a Peruvian port? First, he was already in Peru to attend the Apec Summit; and second, Chancay is as much, if not more, Chinese than it is Peruvian since it is majority financed and owned by Chinese state-owned company Cosco Shipping.

This has raised questions about Peru’s sovereignty. From DW:

In 2021, the national port authority granted Cosco exclusivity to operate Chancay. When this clause was made public, there was a nationwide outcry in Peru.

In March of this year, the government asked the judiciary to annul this provision. (…) But in June, President Dina Boluarte backtracked under pressure from China and abandoned the request to annul the clause. At the same time, the Peruvian Congress adjusted the port law, so that exclusive rights are now allowed for Cosco.

With an estimated total cost of $3.6 billion, the half-finished port in Chancay represents one of the most important infrastructure projects China has spearheaded in the region. The first phase of construction has already cost $1.3 billion and the next five phases will see further investments of another $2.3 billion through 2032.

Chancay is the first port on South America’s Pacific coast that will be able to receive ultra-large vessels – which can transport more than 18,000 containers — and it is hotly tipped to become the main maritime node in Latin America, especially if China’s ambition to forge a new maritime-land corridor between China and Latin America bears fruit.

“China wishes, together with Peru, to use the port of Chancay as a starting point to create a new land and sea corridor between China and Latin America, connecting the Inca Trail with the 21st century Maritime Silk Road, and opening a path to shared prosperity for Peru and for the countries of Latin America and the Caribbean,” Xi said on Thursday during a bilateral meeting with Peruvian President Dina Boluarte, according to Chinese media.

The idea of building a land corridor connecting South America’s Pacific and Atlantic seaboards is hardly a new one. In fact, it has been on the drawing board since the late 19th century. In 2007, the then-heads of state of Brazil, Bolivia and Chile, Lula da Silva, Evo Morales and Michelle Bachelet, agreed to undertake efforts to build a land route connecting the Atlantic port of Santos (Brazil) with the Pacific ports of Arica and Iquique (Chile) or Port of Ilo (Peru) and expedite custom procedures along that route.

But progress has been sporadic…

Continue reading on Naked Capitalism