The economic data for January, Milei’s first full month in office, makes for sobering reading.

Argentina’s latest descent into the economic abyss is as sad as it was predictable. In mid-December, I warned that Milei’s first dose of shock treatment, now being administered with relish by new Economy Minister (and ex-JP Morgan Chase banker, former finance minister and former central bank governor) Luis Caputo, risks wiping out what remains of Argentina’s fragile economy. Said treatment includes a 54% devaluation of the Argentine peso; a halt on all public works; the freezing of public sector salaries and pensions; a sharp rise in taxes, and the elimination of many public subsidies, including for energy and public transportation.

Now, the economic data is emerging for January, Milei’s first full month in office, and it makes for scary reading. But before we get into the nitty-gritty, a reminder: the economic pain currently being visited upon millions of Argentinean workers and pensioners is an integral part of Milei’s economic plan. It is not an unfortunate by-product or unintended consequence; it is the intended goal — to impoverish workers and pensioners to the point where they cannot fill their shopping basket or buy even the most basic of necessities. If you starve the economy of demand, inflation eventually has to go down.

Last week, El Economista published an article titled: “Due to the monetary squeeze, inflation and recession, savers sell dollars to make ends meet”. The article was harshly critical of the government’s brutal austerity regime but that didn’t stop Milei from proudly retweeting it. Presumably, he never bothered to read the text.

As I noted in my December 15 article, “Who Is Luis Caputo, Argentina’s New Economy Minister (Who Is Already Making the Economy Scream)?” most Argentinians, many of whom voted for Milei out of an understandable mixture of desperation, frustration and anger with the establishment parties, face a crushing loss of purchasing power, both in pesos and dollars, as the devaluation and rising taxes drive inflation even higher while wages and pensions stagnate and public subsidies on energy and public transport are withdrawn.

Stagflation on Steroids

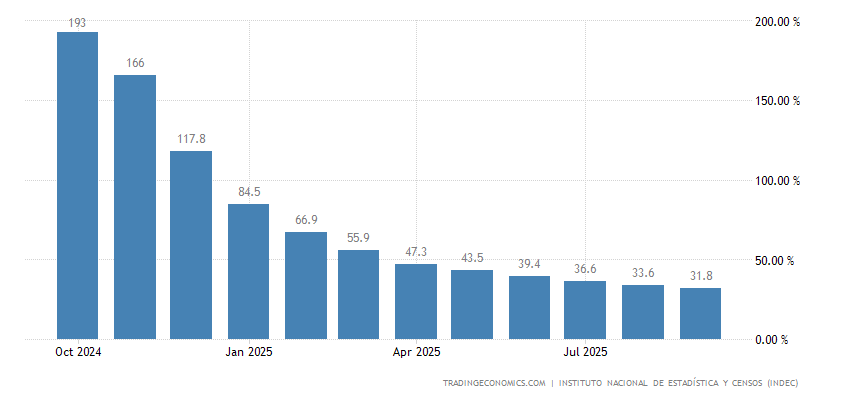

Prices are indeed surging. On a year-by-year basis CPI increased from 211% in December to 254% in January, its highest level since 1990.

The 54% devaluation of the Argentine peso obviously played a key part in this. So too has the removal of subsidies for many basic goods and services, including energy and public transportation, as well as the sharp rise in taxes, including import taxes — from a man who repeatedly said before the elections he would rather cut off an arm than increase taxes. The price of just about everything is surging — everything, that is, except salaries. In a country where the poverty rate is already above 40%. As NC has reported before, this kind of austerity literally kills, through desperation, suicide and lack of access to basic health services.

The one silver lining? Inflation did fall on a month-by-month basis from 25% in December to 20% in January. In other words, the price rises may be in the process of plateauing — which is perhaps no great surprise: when you throttle economic activity and opportunity, price rises tend to slow. But so too does everything else…

Continue reading on Naked Capitalism